The minimum satisfactory credit score is 620. Minnesota Housing Score Loan is an alternative program that covers up to 4%. If you do not qualify for the FirstHome program, do not despair. It is important to note that this option comes in the form of a 30-year-fixed-rate second loan only. This option covers up to 6% of the loan amount toward down payment and/or the closing costs. In particular, first-time home buyers can apply for FirstHome – down payment and closing costs assistance program, if they qualify for a FHA loan and their FICO score is at least 660. Many first-time homebuyers can find options which most fit their budget.īesides these government-guaranteed programs, it is worth considering some offers from UHC (Minnesota Housing Corporation) available to Minnesotans. Tips for first-time home buyers in Minnesotaįirst, there are several federal agencies (USDA, FHA and VA) that guarantee loans for selected borrowers. It is important to note that the calculated M value is approximate, as no extra fees are taken into account. So, you are going to pay about $4042 a month. The principal amount (P) will be equal to 90% of the initial home cost ($500,000 – $50,000 = $450,000).įinally, let’s convert the loan length from years to months: N = 15 * 12 = 180. The house costs $500k, with 10% ($50,000) to be paid down. Imagine you are applying for a 15-year mortgage loan with a fixed 6.99% APR (which is. N – the loan term expressed in months (in other words, the overall number of monthly payments) I – monthly interest rate (to determine it, divide your annual mortgage rate by 12) It's powered by a simple formula, which you can also use to calculate the amount to be paid by hand: The most convenient way to do this is to make use of our calculator. Nevertheless, the pace of growth has diminished compared to the previous year, while both purchase and refinance rates have been on the increase for some time and are expected to rise further in the near future. This continues a longstanding trend amplified by the COVID pandemic. The past year has seen a steep increase in the market value of housing in Minnesota. Source: American Communities Survey 2016, U.S. Many lenders insist on setting up a mortgage escrow account to ensure the borrower’s keeping up with the tax and insurance costs. The property tax is another important thing to consider when selecting your future house. Median property taxes in Minnesota counties origination fee, closing costs, insurance payments etc).įor more precise assessment, the interest rate used for these calculations is based on the current mortgage rates in Minnesota, given a $400,000 home price and a 10% down payment. Although the interest rate makes up the bulk of the APR value, the latter also includes various fees (e.g.

It is worth mentioning that you are actually charged an annual percentage rate (commonly abbreviated as APR), which is not exactly the same as the interest rate. Fixed-rate conforming loans are allowed to last 30 years most, while adjustable-rate options typically have shorter terms.Īn interest rate is a fixed or floating fraction of the principal that you must pay through the duration of the loan.

#MORTGAGE CALCULATOR MN FULL#

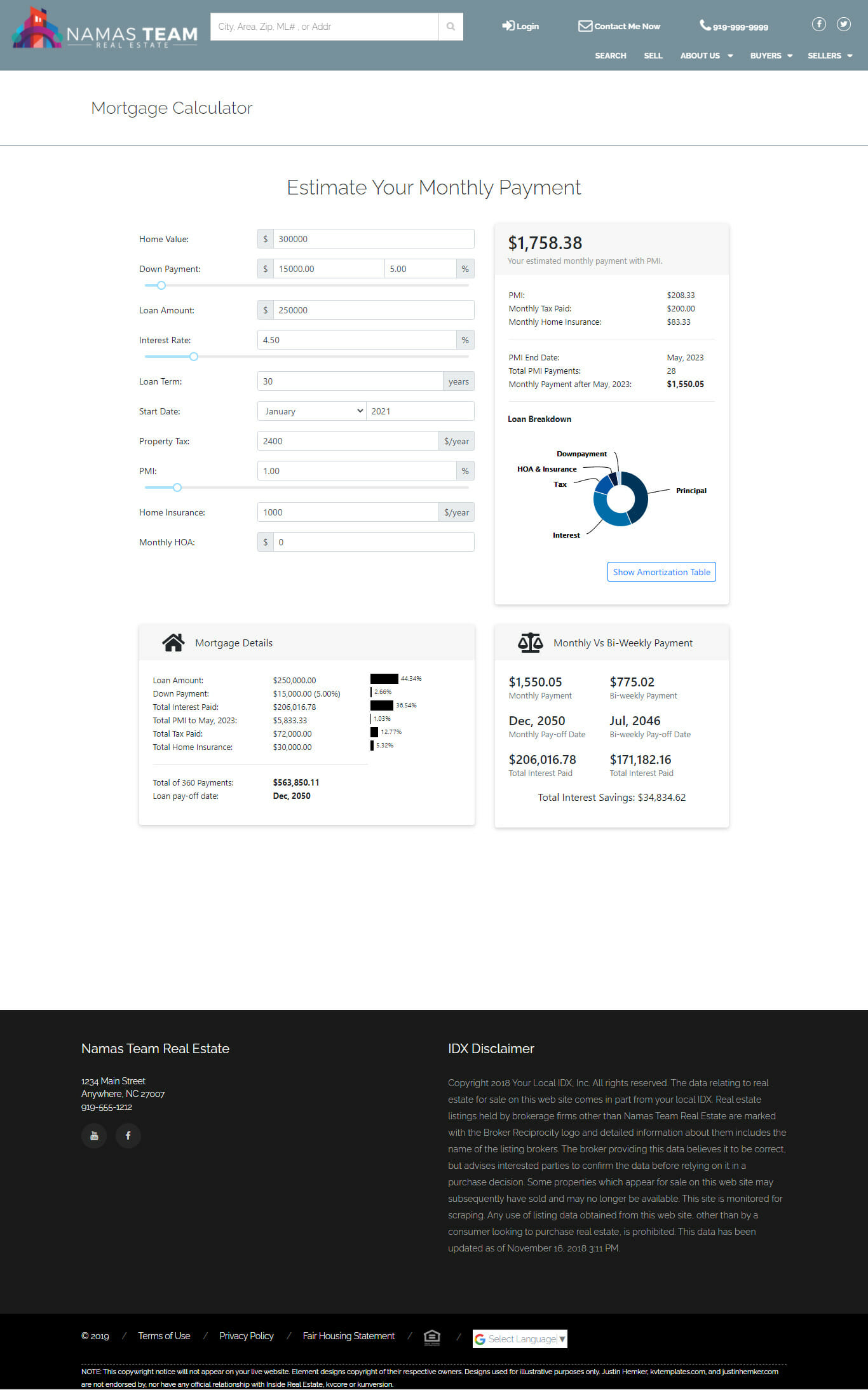

80% of the home price given a 20% down payment).Ī loan term is the period of full repayment of your mortgage by making scheduled payments. The remaining amount makes up the principal (e.g. To avoid costly insurance, you must come up with at least 20% down (in case of a conventional loan). A down payment is the portion of this price to be paid upfront. The first piece of the puzzle is the home price – that is, how much you are planning to spend on your future property. Let’s take a closer look at each field in order to gain a better understanding of the mortgage in Minnesota parameters. Use our house payment calculator Minnesota for thorough planning of your future spendings.

#MORTGAGE CALCULATOR MN HOW TO#

Why and How to Use Our Mortgage Calculator A detailed step-by-step instruction follows below. Use our fast and simple mortgage calculator MN to evaluate your future monthly expenses. How to calculate mortgage payment in Minnesota Several lesser known but trustworthy options include Minnesota-based Minnesota Residential Mortgage Inc, First Class Mortgage Inc. These include such recognizable names as Rocket Mortgage, Change Home Mortgage, AmeriSave. The most popular mortgage lenders in Minnesota operate nationwide.

0 kommentar(er)

0 kommentar(er)